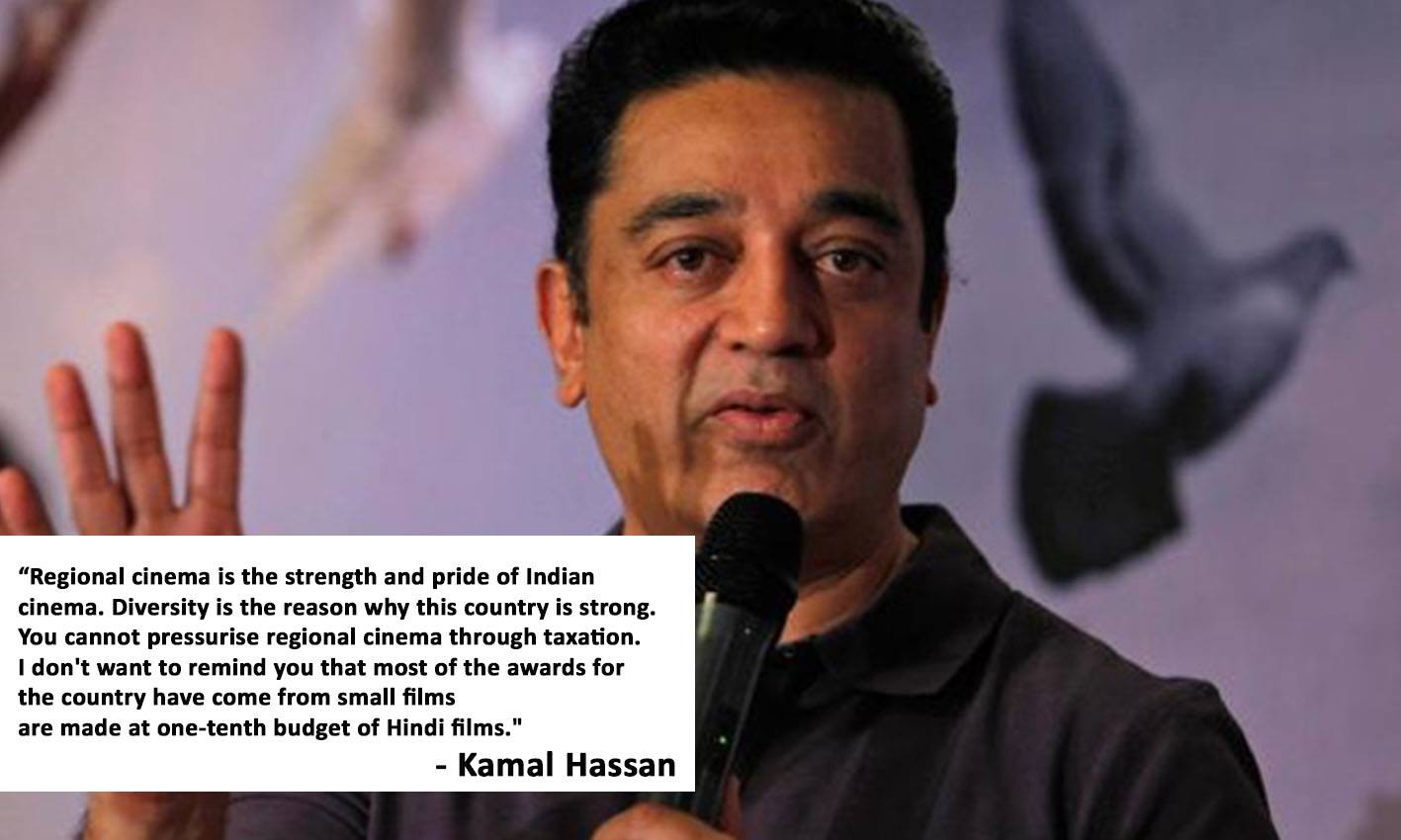

Kamal Haasan Is Miffed With The Government For GST Rate Proposed On Entertainment Tax

He said, “Regional cinema is the strength and pride of Indian cinema. Diversity is the reason why this country is strong. You cannot pressurise regional cinema through taxation. I don’t want to remind you that most of the awards for the country have come from small films which are made at one-tenth budget of Hindi films.”

Also Read: Birthday Special: 10 Must Watch Movies Of Kamal Haasan

South Indian Film Chamber of Commerce President Kalyan was also said that regional cinema shouldn’t be placed with national and Hollywood movies at the GST tax slab.

In a statement, the chamber said, “Regional movies were made on ‘minuscule’ budgets, unlike Bollywood and Hollywood films. Of 2,100 films made in India in 2016, 1,700 were in the regional languages. This kind of high rates of tax will kill the regional films.” They appealed to the Centre to reduce the GST tax rate to 18 per cent, copyright sale rate from 12 per cent to five per cent and the slab for services like artistes, and technicians to 12 per cent from 18 per cent.

Should government reduce the GST tax on cinema? Do share your thoughts in the section below.